Simplified Customs Documentation for China-Consolidated Shipments: A Guide for European & North American Businesses”

Introduction: Navigating the Complexity of Cross-Border Shipping

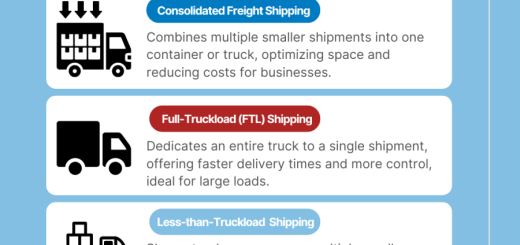

Importing goods from China to Europe or North America can be a logistical nightmare. Between tariffs, Incoterms, and compliance regulations, customs documentation often becomes a barrier for small businesses. However, consolidated shipping—grouping multiple orders into a single shipment—can slash costs and simplify paperwork. This guide explores strategies to streamline customs processes for EU and US-based businesses in 2024.

Key Sections (SEO-Optimized Structure):

1. The Pain Points of Individual Shipments

- Why avoid sending parcels individually?

- Higher per-unit shipping costs (e.g., 50/kgviaexpressvs.50/kgviaexpressvs.5/kg via LCL sea freight).

- Frequent customs delays due to incomplete documentation.

- Exponentially higher tariffs on small packages (e.g., EU’s €150 de minimis threshold per shipment).

2. The Power of Consolidation: How It Works

- Step-by-Step Process:

- Source Products: Buy from multiple Chinese suppliers.

- Warehouse Consolidation: Send goods to a Chinese fulfillment center (e.g., Cainiao, PFL) to bundle shipments.

- Single Customs Declaration: File one set of documents for the entire shipment.

- Destination Clearance: Pay tariffs once, reducing compliance risks.

- Benefits:

- Cost savings: Up to 70% cheaper than individual shipments.

- Faster clearance: Fewer customs checks with consolidated documentation.

- Tax efficiency: Spread tariffs across bulk shipments (critical for EU VAT/US duties).

3. Essential Documents for Consolidated Shipments

- Must-Have Documents:

- Commercial Invoice: Details of goods, value, and sender/receiver info.

- Packing List: Quantities and weights of each item.

- Bill of Lading (BOL)/Air Waybill: proof of contract between shipper and carrier.

- Certificate of Origin (COO): For preferential tariffs (e.g., EU-China trade agreements).

- Harmonized System (HS) Codes: Accurate classification to avoid fines.

- EU-Specific Requirements:

- Importer Authorization: EORI number for customs.

- Sanitary/Phytosanitary Certificates: For food, cosmetics, or textiles.

- US-Specific Requirements:

- Bonded Carrier: Use CBP-approved forwarders for ISF filing.

- FDA/CPSC Compliance: Proof of product safety (e.g., toy testing, electronics certifications).

4. How to Choose the Right Freight Forwarder

- Red Flags to Avoid:

- Hidden fees (e.g., “destination handling charges”).

- Lack of transparency on Incoterms (prefer FOB Shanghai for cost control).

- No online tracking or document portal.

- Top-Rated Options:

- For EU: DHL Supply Chain, Kuehne + Nagel.

- For US: Freightos, Flexport, or local agents like OEC Group.

- Budget Option: Platforms like Alibaba Logistics or Cainiao for SMEs.

5. Tech Tools to Automate Compliance

- Software Recommendations:

- TradeGecko: Auto-generate invoices and packing lists.

- ShipHero: Track inventory across Chinese warehouses.

- CustomsHawk: Validate HS codes and duty rates in seconds.

- Pro Tip: Use spreadsheets to log HS codes, tariffs, and Incoterms for recurring products.

6. Case Study: A US Startup Cuts Shipping Costs by 65%

- Challenge: A Seattle tech accessories company spent $8,000/month on individual DHL shipments.

- Solution: Partnered with Freightos for monthly consolidated LCL sea freight.

- Results:

- Costs dropped to $2,800/month.

- Customs delays reduced by 90% (single declaration vs. 50+ individual filings).

- Passed savings to customers, boosting repeat sales.

7. Common Mistakes to Avoid

- Mistake 1: Overlooking insurance. Consolidated shipments risk damage; always insure high-value goods.

- Mistake 2: Incorrect HS codes. Use the EU’s Taric or US HTS database to verify.

- Mistake 3: Ignoring Incoterms. Clarify responsibility for freight (e.g., FOB vs. DDP) in contracts.

8. Advanced Strategies for Tariff Reduction

- Leverage Free Trade Agreements:

- EU: Use origin certificates for duty-free imports under EU-China deals.

- US: Apply Section 301 tariff exclusions for certain products.

- Split Shipments: For goods with different tariffs, segregate them to avoid blended rates.

- Reverse Engineering: Work with suppliers to reclassify products under lower-tax categories.

9. Post-Arrival Compliance

- EU VAT Triangulation: If selling within the EU, register for VAT in a single member state.

- US Revenue Rulings: Ensure post-arrival labeling complies with FTC guidelines.

- Record-Keeping: Retain documents for at least 5 years (EU) or 3 years (US).