German Outdoor Gear Shops: Stocking Up on Chinese Adventure Equipment with Consolidation

Subtitle: Cut Costs by 40–60%, Reduce Lead Times by 30–40%, and Meet EU Standards for Alpine-Ready Gear

Germany’s outdoor gear market is a €5.2 billion industry, driven by a nation of passionate adventurers—62% of adults hike, camp, or climb regularly, with the Alps, Black Forest, and North Sea coast drawing millions annually. For local shops, from Munich’s alpine boutiques to Berlin’s urban outdoor stores, staying competitive means balancing quality, affordability, and inventory turnover. Chinese manufacturers have emerged as critical partners, offering tents, hiking boots, and survival gear that match European standards at 30–50% lower prices. Yet, importing small batches of specialized equipment efficiently remains a logistical hurdle. Consolidation shipping—aggregating orders from multiple Chinese suppliers into one optimized shipment—has become the solution, enabling German outdoor shops to reduce logistics costs by 40–60%, slash restocking times by 30–40%, and simplify compliance with EU regulations. This guide explains how consolidation transforms Chinese gear imports for seamless stocking in Germany.

Why German Outdoor Shops Choose Chinese Adventure Equipment

Germany’s outdoor culture demands gear that thrives in extreme conditions: sub-zero Alpine winters, rain-soaked Black Forest trails, and windy North Sea expeditions. Chinese manufacturers deliver three key advantages that align with these needs:

1. Cost Efficiency for Price-Sensitive German Shoppers

German consumers are savvy comparers, with 68% checking prices across EU platforms before purchasing (average outdoor gear spend: €150–€300 annually). Chinese suppliers deliver significant savings:

- Hiking Boots: Waterproof leather boots with Vibram soles cost €50–€80, vs. €130–€220 from German brands like Lowa.

- 4-Season Tents: PU 5000mm waterproof tents with aluminum frames retail for €85–€120 in China, compared to €200–€350 from EU brands like Vaude.

- Multi-Tools: 18-in-1 survival kits (knife, fire starter, compass) price at €18–€25 in China, vs. €45–€75 from Victorinox.

For a mid-sized shop in Cologne with 3 locations, these savings translate to €40,000–€60,000 annually—funds that can be reinvested in in-store demos or online marketing. “Chinese gear lets us offer ‘buy one, get one half off’ promotions without cutting margins,” notes a Munich shop owner.

2. Quality & Compliance with German Standards

Germany’s strict regulations and outdoor culture demand gear that meets rigorous standards:

- CE Certification: All equipment complies with EU safety norms (e.g., EN 13775 for tents, EN 345 for climbing harnesses).

- Weather Resistance: Tents with reinforced seams, boots with 20,000mm waterproofing, and UV-stable fabrics—critical for Germany’s 180+ rainy days annually.

- Sustainability: OEKO-TEX® certified apparel, FSC® certified wooden gear, and recyclable packaging—aligning with 72% of German consumers who prioritize eco-friendly products.

A Freiburg-based shop tested Chinese vs. European tents in the Black Forest: “Both withstood 3 days of heavy rain, but the Chinese tent cost half as much. Our customers couldn’t tell the difference in performance.”

3. Diversity for Niche Outdoor Pursuits

Germany’s outdoor scene spans alpine climbers, family campers, and urban adventurers. Chinese suppliers cater to all:

- Alpine Gear: Crampons, ice axes, and high-altitude sleeping bags for the Zugspitze.

- Family Camping: 6-person tents with room dividers, kid-sized hiking boots, and portable grills.

- Urban-to-Wild: Foldable backpacks, waterproof phone cases, and reflective jackets for commuter-hikers.

A Salzburg shop specializing in ski tours reports: “Chinese suppliers offer 5x more avalanche transceiver models than European brands, helping us dominate that niche.”

How Consolidation Transforms German Outdoor Gear Imports

For German shops, importing individual items from China (a tent from Zhejiang, boots from Guangdong) is costly and disjointed. Consolidation—combining these into one shipment—solves critical pain points:

1. Significant Cost Savings

- Lower Per-Unit Shipping: Sending 100 hiking boots via DHL costs €12–€18 each. Consolidating 500 items (gear, apparel, tools) drops the rate to €2–€4 per unit, saving 70–80%.

- Bulk Freight Discounts: Consolidators negotiate 30–35% off rail freight for 500kg+ orders and pass savings to shops. A Berlin chain with 5 stores saved €32,000 last year using consolidated rail shipping.

- Reduced Overhead: Managing 8–10 shipments eats up 15–20 hours/week. Consolidation cuts this to 3–5 hours, freeing staff to assist customers.

2. Faster, Predictable Inventory Replenishment

- Optimized Routes for Germany:

| Transport | Cost (per kg) | Transit Time | Best For |

| Air Freight | €8–€12 | 5–7 days | Urgent restocks (e.g., pre-ski season). |

| Rail Freight | €3–€5 | 18–22 days | Regular bulk orders (tents, boots). |

| Sea + Truck | €1.50–€3 | 28–32 days | Seasonal stock (e.g., summer camping gear). |

- Seasonal Alignment: Fixed shipping windows sync with Germany’s outdoor calendar:

- March–April: Rail freight for spring hiking gear (arrives before Alpine trails thaw).

- September–October: Air freight for winter equipment (avalanche beacons, -20°C sleeping bags).

- November–December: Sea freight for bulk restocks (preparing for post-holiday sales).

3. Quality Control & Compliance Simplified

- In-China Inspections: Consolidation warehouses verify:

This reduces defective items from 12–15% (individual shipping) to 2–3%, cutting return costs by 90%.

- Tent waterproofing (via 5,000mm water column tests).

- Boot sole adhesion (meeting EN 20345 standards).

– 德语 Labeling (e.g., “Waschen bei 30°C” for apparel, “CE-zertifiziert” for tools).

- Regulatory Expertise: Consolidators handle EU paperwork:

A Nuremberg shop avoided a €5,000 fine for missing CE labels after switching to a consolidator with compliance experts.

- Commercial invoices with HS codes (e.g., 6403 for hiking boots, 6306 for tents).

- CE certificates and material safety data sheets (MSDS).

- Origin declarations to qualify for EU low-value exemptions (≤€150).

The Consolidation Process: From Chinese Factories to German Shelves

Importing outdoor gear via consolidation follows a streamlined workflow, designed to protect equipment and accelerate shelf readiness:

Step 1: Supplier Coordination & Inventory Planning

- Multi-Supplier Aggregation: Shops source from 5–8 Chinese suppliers and direct all shipments to a single consolidation warehouse (e.g., Guangzhou, Shanghai). A Cologne shop explains: “We share our quarterly forecast with suppliers—they ship to China by the 15th, and we consolidate once to avoid partial deliveries.”

- Free Storage: 30–45 days of complimentary warehousing in China lets shops aggregate gear (e.g., 200 tents + 300 boots) before shipping, ensuring full product lines arrive together.

Step 2: China Warehouse Processing

- Kitting & Branding: Items for promotions (e.g., “Alpine Starter Kit”) are grouped and tagged with shop SKUs. Private-label gear (e.g., “Berlin Outdoor” jackets) receives custom logos.

- Dimensional Optimization: Excess packaging removed (tents compressed, boots nested) to reduce volume by 20–25%, lowering freight costs.

- Quality Checks: Third-party inspectors test zippers, seams, and hardware—critical for gear durability.

Step 3: Shipping to Germany

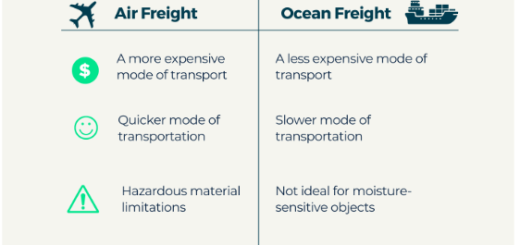

- Route Selection Based on Urgency:

- Air: Ideal for last-minute ski season restocks (5–7 days).

- Rail: Balances speed and cost for regular orders (18–22 days).

- Sea: Lowest cost for bulk seasonal items (28–32 days).

- Real-Time Tracking: Shops monitor shipments via German-language dashboards (e.g., “Verlässt Shenzhen” [Leaves Shenzhen], “In München Lager” [In Munich Warehouse]) with alerts for delays (e.g., port congestion in Hamburg).

Step 4: Customs Clearance & In-Store Delivery

- Documentation Excellence: Consolidators prepare paperwork to breeze through German customs:

- Detailed invoices with specs (e.g., “4-season tent, CE certified, 250cm x 300cm”).

- CE certificates and OEKO-TEX® reports.

- Low-value declarations for small items (≤€150).

- Duty & Tax Handling: For shipments over €150, consolidators calculate and prepay 19% German VAT and 4% import duty, providing a single invoice for German accounting (DATEV, SAP).

- Shelf-Ready Service: Gear is transported to shops via climate-controlled vans. Many providers offer “retail-ready” delivery: unpacking, applying price tags, and setting up displays (e.g., tent demos, boot fitting stations)—saving German shops 6–8 hours of labor per shipment.

Case Study: A German Outdoor Shop’s Success

A 3-store chain in Bavaria (annual revenue €2.5M) faced challenges importing Chinese gear:

- Previous Struggles:

- High costs: €15 per tent in shipping.

- Defects: 10% of sleeping bags arrived with broken zippers, costing €8,000 in replacements.

- Delays: 25% of winter gear missed November (peak ski season).

- Solution: Partnered with a consolidation provider specializing in outdoor equipment:

- Custom packaging for tents (shock-absorbing foam).

- Rail shipments timed to arrive 3 weeks before ski season.

- Pre-shipment testing (waterproofing, zipper durability).

- Results:

- Costs: Shipping 2,000 items via rail cost €4,000 total (€2 per item), saving €26,000 vs. individual shipping.

- Quality: Defective gear dropped to 1%, eliminating replacement costs.

- Timelines: Rail deliveries arrived 21 days after ordering, ensuring 100% stock for November’s peak season.

- Sales Impact: Faster restocks and lower prices boosted same-store sales by 18%, with customer reviews praising “great deals on reliable gear.”

Choosing the Right Consolidation Partner

German outdoor shops should prioritize providers with:

- Outdoor Gear Expertise: Experience shipping tents, climbing equipment, and apparel—with staff trained in handling fragile items (e.g., avalanche transceivers).

- Germany-China Network: Offices in Guangzhou and Munich for on-the-ground support (e.g., resolving supplier delays or sizing issues).

- Sustainability Credentials: Carbon-neutral shipping (e.g., rail with wind energy offsets) to align with Germany’s eco-conscious shoppers.

- Speed Guarantees: Contracts with penalties for delays (e.g., €500/day for late winter gear shipments).

Conclusion

For German outdoor gear shops, consolidation transforms Chinese equipment imports from a logistical challenge into a competitive advantage. By combining cost savings, faster inventory turns, and compliance expertise, shops can offer better prices, stock more diverse products, and outpace competitors. Whether supplying alpine climbers or family campers, consolidation ensures gear arrives on time, intact, and ready to perform in Germany’s toughest outdoor environments—proving that smart logistics are the key to thriving in this dynamic market.