Simplify Your Cross-Border Imports: A Step-by-Step Guide to Navigating Customs with Consolidated Shipments from China for Europe & North America

Managing customs clearance for consolidated shipments from China to Europe or North America can feel like navigating a labyrinth of regulations, paperwork, and unexpected fees. Whether you’re a business importing electronics from Alibaba, a Taobao shopper bringing home decor to Germany, or an Amazon seller sourcing furniture to the US, consolidating multiple orders into one shipment streamlines logistics but introduces unique customs challenges. This comprehensive, SEO-optimized guide breaks down every aspect of navigating customs for consolidated shipments, tailored specifically for buyers in the EU, UK, US, and Canada.

We’ll explain why consolidation simplifies but complicates customs, walk through required documentation, duty calculations, and compliance rules, share actionable strategies to avoid delays and fees, and provide real-world examples to help you master the process confidently.

🔍 Why Consolidation Matters for Customs—and the Risks

Benefits of Consolidation

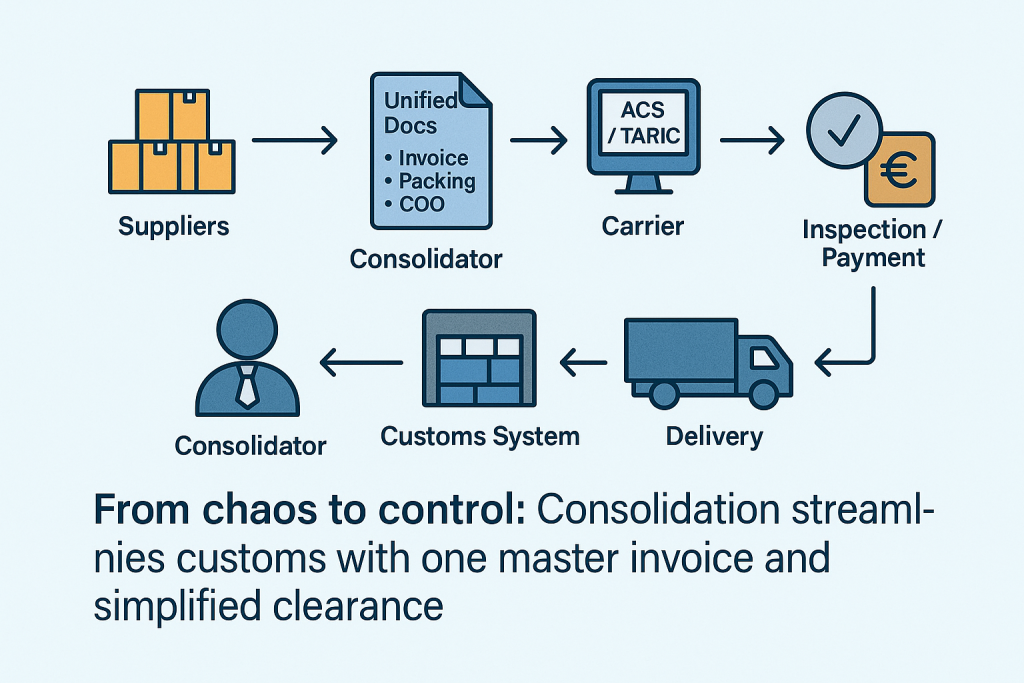

- Streamlined Processing: One master shipment vs. multiple individual entries reduces customs workload and lowers inspection chances.

- Cost Savings: Bulk shipping often qualifies for lower freight rates and economies of scale, offsetting potential duty increases.

- Reduced Paperwork: Single unified documentation replaces multiple commercial invoices, packing lists, and certificates.

- DDP Advantage: Consolidators often handle customs clearance Delivered Duty Paid (DDP), covering taxes upfront—no surprises at delivery.

Customs Challenges with Consolidation

- Mixed Categories: Electronics + textiles + furniture in one shipment → complex Harmonized System (HS) coding and duty rate variations.

- Valuation Accuracy: Ensuring the declared value matches all items without under/over-declaring risks penalties or seizures.

- Compliance Verification: Carriers/consolidators must validate CE/FCC/RoHS compliance for electronics, labeling for textiles, and safety certifications for furniture.

- Origin Rules: USMCA/EU preferences require precise country-of-origin claims to qualify for tariff reductions.

- High-Value Triggers: One consolidated shipment >€150 (EU)/$800 (US) minimum de minimis thresholds → duty/ VAT always applies.

📋 Critical Customs Documentation for Consolidated Shipments

To avoid delays or fines, complete, accurate documentation is non-negotiable. Your consolidator will prepare or require these key documents:

1. Commercial Invoice (Master Document)

- Lists all items from all suppliers in the shipment:

- Description: Clear, detailed (e.g., “24-inch LED monitor, model XYZ, with HDMI port”).

- HS Code: Correct 6–10-digit code from the destination’s tariff system (e.g., EU TARIC or US HTS).

- Electronics: CE/FCC certified → HS 8528 (monitors), 8508 (blenders).

- Textiles: Labeled material composition → HS 6307 (home textiles).

- Furniture: Wooden desks → HS 9403.

- Quantity, Value per Unit: Total value per item category (e.g., “5 × $150 monitors = $750”).

- Seller/Buyer Info: Full legal names, addresses, EORI (EU/UK) or tax ID (US/CA).

- Shipment Terms: EXW/FCA/FOB/CIF clearly stated (consolidators often use FCA warehouse).

- Why It’s Critical: Customs uses this to calculate duties/taxes and verify compliance with origin/valuation rules.

2. Packing List (Master & Itemized)

- Summarizes the shipment’s contents by weight, dimensions, and packaging:

- Actual weight (kg) and volumetric weight calculation (if applicable).

- Master carton dimensions (L×W×H cm) → critical for air freight volumetric fees and customs inspections.

- Item-level breakdown (optional but helpful): Supplier names, tracking IDs, individual box contents/labels.

3. Certificates of Origin (COO)

- Required for preferential tariff treatment under trade agreements like USMCA (North America) or EU’s GSP+.

- Consolidators verify origin claims (e.g., “Made in China” vs. Vietnam re-export) via supplier invoices and labels.

- Example: For a US-bound shipment with Chinese-made parts qualifying for USMCA, include a signed COO affidavit.

4. Compliance Documents

- CE/FCC/RoHS Certificates: For electronics, appliances, or toys—consolidators must confirm visible labels and documentation to avoid seizure.

- Testing Reports: For regulated items like cosmetics, food supplements, or medical devices.

- Licenses/Permits: Restricted items (e.g., batteries exceeding UN3480 for air freight) need special handling.

5. Bill of Lading (B/L) or Airway Bill (AWB)

- Issued by the carrier (DHL/UPS/FedEx or sea freight forwarder):

- Shows consolidator as shipper and your address as consignee.

- Includes unique tracking number and shipment details (weight, volume, value).

📌 Example: EU Customs Documentation for a Mixed Shipment

Shipment: 10 smartwatches (HS 9102), 20 bamboo chairs (HS 9403), 50 cotton towels (HS 6307).

- Commercial Invoice:

- Total value: €1,200 (€500 watches + €400 chairs + €300 towels).

- Terms: FCA Guangzhou Warehouse.

- Origin: All items China-made → no USMCA/EU preference applied.

- Packing List: Master carton 120×60×50 cm → volumetric weight 60 kg (air freight billing).

- CE/FCC: Watches labeled CE; chairs RoHS-compliant bamboo verified.

⚖️ Calculating Duties, Taxes, and Fees for Consolidated Shipments

Customs charges vary widely by destination country, product category, and declared value. Below is a breakdown for major regions:

1. Customs Value Definition

- Formula: Typically transaction value (what you paid suppliers + shipping to consolidation warehouse) → not including international freight/insurance.

- Exceptions: If no sales receipt, customs uses identical/similar goods value.

2. Duty Rates by Region

| Product Type | US HTS Rate | EU TARIC Rate | UK Post-Brexit |

|---|---|---|---|

| Electronics (monitors, phones) | 0–3.7% (HS 8528) | 0–4.5% (HS 8528) | 0–4.5% (similar to EU) |

| Furniture (wood) | 0–8% (HS 9403) | 0–8% (HS 9403) | 0–8% |

| Textiles (towels, clothing) | 0–16% (cotton: HS 6307) | 0–12% (cotton: HS 6307) | Similar to EU |

| Toys/Games | 6.5% avg. | 0–7% | Similar to EU |

| Cosmetics | 0–15% + VAT | 0–15% + VAT | Similar to EU |

*Note: Tariffs are subject to change—verify via official databases:

- US: HTS Lookup

- EU: TARIC

- UK: Tariff Tool*

3. Value-Added Tax (VAT) & Sales Tax

- EU: VAT charged on customs value + duties → typical rate 19–25% (e.g., Germany 19%, France 20%).

- UK: Similar to EU; applies to goods >£135 (excluding some gifts/samples).

- US: No federal VAT, but state/local sales taxes may apply after customs release.

- Canada: GST/HST (5–15%) added to customs value + duties.

4. Example Calculation: US Shipment

Shipment: 20 LED monitors (HS 8528, $150/unit = $3,000 total value).

- Duty: $3,000 × 3.7% = **$111**.

- No VAT in US, but California sales tax (7.5%) applies locally → $3,000 × 7.5% = $225 post-customs.

- Total Customs Cost: $111 duty + possible broker fees ($50–$200 avg.).

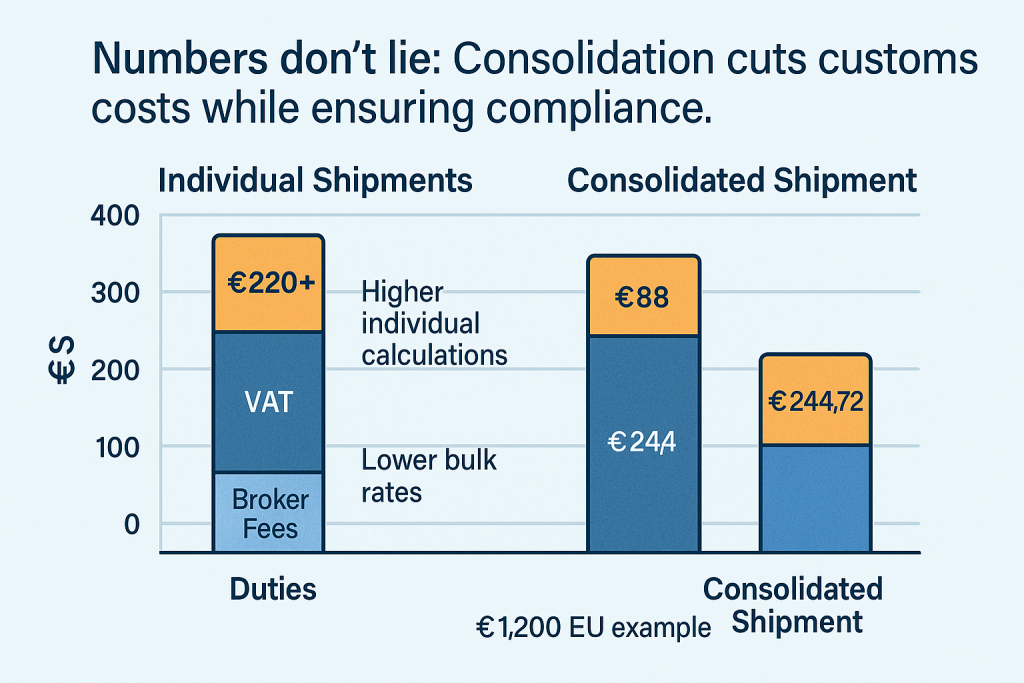

5. Example Calculation: EU Shipment

Shipment: Smartwatch mix (€500) + chairs (€400) + towels (€300) = €1,200 total.

- Duty:

- Watches: €500 × 4% = €20.

- Chairs: €400 × 8% = €32.

- Towels: €300 × 12% = €36.

→ Total Duty: €88.

- VAT: (€1,200 + €88) × 19% (Germany) = €1,288 × 0.19 = €244.72.

- Total Customs Cost: €88 + €244.72 = €332.72 + broker fee (~€50–€100).

6. Carrier Fees & Surcharges

Consolidated shipments often incur additional fees:

- Brokerage/Handling Fees: €50–€200 (EU) or $50–$300 (US) for customs agency services.

- Remote Area Surcharges: If your address is hard-to-reach (e.g., rural Alaska, Scottish Highlands) → added to freight + customs costs.

- Security Surcharges: Standard 0.3–0.5% of customs value for air/sea shipments.

📌 Critical Tip

DDP Option is Your Safest Bet: Choose consolidators offering Delivered Duty Paid (DDP) service → they prepay all duties, taxes, and fees upfront. For example:

- Your $3,000 US shipment with $111 duty + $200 broker fee = **$3,311 total cost**—no hidden fees at delivery.

🛡️ Compliance Essentials for Electronics, Textiles & More

1. Electronics & Tech Products

- CE/FCC Certification:

- Monitors, phones, smartwatches must display visible CE (EU/UK) or FCC (US/CA) labels.

- Consolidators verify compliance via inspection photos/invoices—missing labels risk seizure or fines.

- Battery Handling: Lithium-ion batteries require special UN-certified packaging (IATA DGR rules) for air freight.

- RoHS Standards: Restricted hazardous substances (lead, mercury) → ensure suppliers confirm compliance.

2. Textiles, Clothing & Home Goods

- Labeling:

- Content composition (e.g., “100% cotton”) per FTC (US)/EU regulations.

- Country of origin labels required for customs verification.

- Duty Optimization: Knitted vs. woven fabrics affect HS codes (e.g., towels: HS 6307 vs. clothing: HS 6101).

3. Furniture & Large Items

- Wood Packaging: Must comply with ISPM 15 heat-treated wood regulations to prevent pest infestations.

- Safety Certifications: Children’s furniture needs EN71 (EU) or ASTM F963 (US) compliance documentation.

4. Restricted Items

- Avoid prohibited goods like counterfeit brands, ivory, or certain food/drugs.

- Sensitive items (liquids, powders, batteries) require special handling—use consolidator green channels if needed.

🚀 Navigating the Customs Process: Step-by-Step

- Pre-Shipment Prep:

- Share accurate supplier invoices with your consolidator early.

- Confirm CE/FCC/RoHS compliance and origin details for all items.

- Opt for DDP service to simplify payments.

- Consolidator Documentation Handling:

- They create the unified commercial invoice, packing list, and required certificates.

- Verify HS coding accuracy against tariff databases—mistakes lead to overpaid duties.

- Carrier Submission:

- Shipment departs China → carrier submits electronic declaration (e.g., ACS in US, EDI in EU).

- Customs authorities review documentation for completeness, valuation, and compliance.

- Potential Inspection:

- High-risk shipments (electronics, mixed categories) may face physical checks.

- Consolidators ensure packaging allows easy access for customs officers—no excessive tape/wrapping.

- Payment & Release:

- If DDP: Fees paid upfront → shipment released quickly.

- If unpaid: You receive customs bill → pay via carrier portal/broker → goods delivered.

- Final Delivery:

- Track via carrier updates → consolidated shipment arrives at your address.

⚠️ How to Avoid Delays

- Submit Documents Early: Incomplete info causes holds—provide details 7–10 days pre-shipment.

- Be Responsive: Reply promptly to customs broker queries about valuation or compliance gaps.

- Choose Reliable Partners: Work with consolidators experienced in your product type and destination.

💡 Advanced Strategies to Minimize Costs & Risks

1. Optimize HS Coding for Lower Duties

- Research tariff engineering opportunities:

- Textile blends → classify under lower-rate subcategories (e.g., “home textiles” HS 6307 vs. “apparel” HS 6101).

- Electronics components vs. finished devices → sometimes lower duties for parts.

2. Utilize Trade Agreements

- For shipments to US/Mexico/Canada: Use USMCA origin claims if all materials/components meet regional value content rules → duty reductions.

- For EU/UK: Seek GSP+ or other preference programs if eligible.

3. Split Shipments Strategically

- If your consolidated shipment exceeds de minimis thresholds:

- US: Split into ≤$800 batches → avoid customs entirely (but lose consolidation freight savings).

- EU: ≤€150 batches → no VAT/duty.

4. Time Shipments to Avoid Peak Surcharges

- Black Friday/Cyber Monday → higher fuel surcharges and carrier delays → Plan 3–4 weeks early.

- Chinese New Year shutdowns → Schedule shipments to arrive before/after disruptions.

5. Choose Carbon-Neutral Logistics (Optional)

Add eco-friendly options (e.g., DHL GoGreen) → aligns with European sustainability goals at ~$5–$10 extra cost.

6. Verify Origin Claims Rigorously

- False “Made in Vietnam/Thailand” claims to bypass China tariffs violate USMCA/EU rules → heavy penalties.

- Consolidators should cross-check supplier invoices, labels, and COOs.

7. Work with Authorized Economic Operators (AEOs)

AEO-certified consolidators/freight forwarders get priority customs treatment:

- Faster clearance, reduced inspections, simplified documentation.

🚫 Common Customs Pitfalls & Solutions

1. Inaccurate HS Coding

- Problem: Overpay duties (e.g., classifying towels as apparel → higher rate).

- Fix: Use tariff lookup tools; ask consolidators to double-check codes via TARIC/HTS databases.

2. Undervaluing/Overvaluing Goods

- Risk: Penalties for fraud or duty shortfalls; delays for valuation disputes.

- Solution: Base value on supplier invoices + shipping costs to warehouse; avoid “sample” undervaluation claims.

3. Missing Compliance Labels

- Result: Electronics seized; textiles returned for relabeling.

- Action: Require suppliers to ship items with visible CE/FCC/origin tags; inspect photos via consolidator portals.

4. Ignoring Origin Rules

- Issue: Denied USMCA tariff breaks or EU GSP+ benefits.

- Fix: Use consolidators verifying COOs and supplier invoices; keep records of material sourcing.

5. Not Choosing DDP

- Outcome: Unexpected €300+ fees at delivery; cash flow strain.

- Prevention: Always opt for DDP when available—predictable costs justify slightly higher upfront fees.

📦 Case Study: A Successful EU Consolidated Shipment

Business: Sophie’s Berlin Gadget Boutique imports smart home devices and decor.

Shipment: 15 smart bulbs (HS 9405.40, €10/unit), 5 smart plugs (HS 8536.50, €20/unit), 10 bamboo candle holders (HS 9403.81, €15/unit).

Total Value: €150 + €100 + €150 = €400.

Consolidator: Cainiao using DDP service to Germany.

Process:

- Cainiao verifies CE labels on bulbs/plugs and RoHS bamboo certificates.

- Prepares commercial invoice with correct HS codes.

- Air freight consolidation → volumetric weight 18 kg (billed as 20 kg via DHL formula).

- Customs Clearance:

- Duties: €400 × avg. 4% = €16.

- VAT: (€400 + €16) × 19% = €78.04.

- Broker fee: €75.

- Total Paid: €16 + €78.04 + €75 = €169.04 (included in DDP shipping cost).

- Delivery: Arrives in Berlin in 7 days—no delays or extra charges.

Result: Consolidation saved Sophie ~€300 vs. individual shipments while ensuring compliant, stress-free customs clearance.

🌍 Brexit Impact on UK Shipments

Post-Brexit customs for UK-bound consolidated shipments require additional attention:

- New Border Checks: UK now operates own customs procedures—separate from EU TARIC.

- EORI Number: Must obtain UK EORI (in addition to EU if applicable).

- DDP Critical: UK brokers handle new rules efficiently; delays common without DDP service.

📌 Conclusion: Master Customs with Confidence

Navigating customs for consolidated shipments from China to Europe or North America demands preparation, accuracy, and partnership with experts. By understanding documentation requirements, mastering duty calculations, ensuring compliance with CE/FCC/RoHS standards, and leveraging DDP services and consolidation economies, you can turn customs from a nightmare into a streamlined process.