SHEIN’s QR-Code Returns, China Post’s New Tokyo Cargo Lane, Temu’s Uruguay Surge, and More: What This Week’s Headlines Really Mean for Cross‑Border E‑Commerce

By [share] Global Commerce Desk — A practitioner’s commentary for EU/US importers moving goods from China

Executive summary (for busy operators):

Reverse logistics is being rewired at street level in Brazil, air cargo lanes out of China to Japan just got more frequent, Uruguay’s cross‑border appetite is exploding thanks to Temu, Amazon and Shopify delivered muscular Q2 prints, eBay UK is making bulky parcels easier with DHL, and surcharges are rising on ocean lanes as peak season bites. The through‑line? Cross‑border is still growing—but your margin depends on smarter consolidation, proactive tax/compliance handling, and carrier diversification. Below, I break down each data point, why it matters if you consolidate China‑origin orders into the EU or US, and the fast, concrete adjustments you can make now.

1) Reverse logistics is becoming a retail moat: SHEIN + Jadlog scale QR-code returns across Brazil

SHEIN is expanding reverse‑logistics coverage with Brazilian carrier Jadlog, enabling shoppers to return items at 4,000+ neighborhood pickup points (beauty salons, cafés, laundries, stationery stores, etc.) with a QR code, and auto-confirmation that accelerates refunds. Crucially, the operator says this model is ~20% cheaper than traditional door‑to‑door pickup. ecommercebrasil.com.bresginside.com.br

Why this matters to EU/US importers:

- The “QR + pickup point” template is coming for exports too. If you ship D2C into Latin America or Europe, expect platforms and carriers to push dense pickup/drop-off networks with QR‑based labeling to cut first/last‑mile costs and fraud.

- It also resets customer expectations globally: fast refunds, transparent status, fewer courier visits. Translating this into your own operation means:

- Offer customers label‑less returns and consolidated drop‑offs where possible.

- Integrate photo-based RMA verification to speed inspections and reduce “no-fault” disputes.

- Mirror the cost curve: pickup‑point returns are cheaper to process and consolidate than one‑to‑one home collections.

Tactical takeaways:

- If you operate a US/EU returns hub for China‑origin orders, pilot QR‑only RMAs with a dense third‑party locker network in your top countries.

- Write SOPs for returns consolidation: scan on drop-off, barcode‑match to RMA, triage by “resellable vs refurb vs recycle,” and return funds on scan+photo rather than waiting for warehouse put‑away.

- Update PDP/FAQ to highlight “fast refund on drop‑off scan”—it lifts conversion.

2) China Post widens the air bridge: new Jinan–Tokyo cargo service (and Hangzhou–Tokyo earlier this year)

China Post launched a Jinan–Tokyo all‑cargo route on a B737‑800F (flight CF279), operating three times weekly. The inaugural flight departed Aug 8 and landed at Narita, carrying high‑end electronics, cross‑border e‑com parcels, and mail. It’s the first direct cargo link from Jinan to Tokyo and adds redundancy to North Asia air corridors. 新浪财经

This follows the Hangzhou–Tokyo China Post cargo corridor that opened May 22, with reports of 3x weekly frequencies initially and a 3‑hour sector that enables same‑day cross‑border delivery for a large share of parcels. 新浪财经腾讯新闻

Why this matters to shippers:

- Japan is a critical trans‑shipment and distribution node for North Asia. Extra capacity from China Post smooths peak-season volatility for parcels and small freight—especially electronics and fashion.

- If you consolidate in East China (Zhejiang/Jiangsu/Shandong), these lanes can give you quicker air uplift and more stable line-haul to North America/Europe via interline partners.

- For EU importers using air‑sea or air‑rail hybrids, additional Post capacity to Tokyo can shorten lead times into your Asia hub before longer legs.

Tactical takeaways:

- Ask your forwarder about slot access on Post flights ex‑Hangzhou/Jinan for NL/EU/US‑bound consolidated parcels.

- If you ship to Japan or route via Japan, re‑quote air‑parcel tariffs for Q4; capacity additions can yield better rates or priority uplift SLAs.

3) Uruguay becomes a social‑commerce case study: Temu sparks a surge in cross‑border shopping

Since Temu entered Uruguay in 2024, the country’s cross‑border shopping has spiked sharply. Local reports cite triple‑digit growth in cross‑border parcel traffic and users of duty‑free exemptions, with 2025 data showing a massive uptick in duty‑free parcels and participation under simplified regimes—underscoring pent‑up demand for low‑cost imports.

Why this matters beyond Uruguay:

- Small markets can flip demand almost overnight when a social‑commerce platform lowers CAC and logistics friction.

- Watch for policy adjustments (duty‑free limits, per‑parcel caps) as volumes swell. Your job as an importer is to design resilient duty/VAT playbooks for each country, knowing thresholds may tighten.

Tactical takeaways:

- Build a policy matrix that tracks each Latin American and EU market’s de minimis thresholds, duty/VAT on typical HS codes, and return logistics options.

- Add micro‑fulfillment capacity or a regional cross‑dock to keep last‑mile costs predictable when demand surges.

4) Platform earnings reset expectations: Amazon and Shopify both flex international muscle

Amazon Q2 2025: Net sales $167.7B (+13% YoY), with International segment sales of $36.8B (+16% YoY, +11% ex‑FX). Operating income rose to $19.2B. Guidance for Q3 implies continued growth, though investors debated margins. 亚马逊亚马逊新闻

Shopify Q2 2025: Revenue $2.68B (+31% YoY), GMV $87.8B, and the headline: Europe GMV +42% (cc). Shopify credits product improvements like multi‑currency payouts for European merchants, rolled out late 2024, now bearing fruit. s27.q4cdn.comShopify

Why this matters to importers using consolidated freight out of China:

- Amazon’s international growth + Shopify’s EU surge both point to healthy cross‑border demand into Europe and North America.

- This demand supports more frequent consolidations (air and sea‑LCL) and strengthens your case for volume‑tier discounts with forwarders, especially on lanes where integrators are capacity‑constrained.

Tactical takeaways:

- Audit your multi‑channel allocation: which SKUs are Amazon‑bound, which sit on Shopify? Then align lane selection (air vs sea‑LCL) with margin and promise‑date per channel.

- If you sell D2C in the EU on Shopify, lock in IOSS/OSS processes and multi‑currency payouts so you can move faster during peak (when surcharges rise and funds timing matters). Shopify

5) eBay UK adds DHL to “Simple Delivery”—fixing a big‑and‑bulky gap

eBay UK is introducing DHL to its managed Simple Delivery program, enabling private sellers to ship up to 30kg with dimensions up to 120×80×80 cm, with doorstep collection and automatic label creation—beyond Royal Mail and Evri options already present. ChannelXcommunity.ebay.co.uk

Why this matters:

- For cross‑border sellers staging inventory in the UK, cheaper, automated heavy‑parcel options reduce “manual quoting” friction and speed dispatch. Buyer expectations for tracking and delivery windows on bulky goods are better served with an integrated express partner.

Tactical takeaways:

- If you do UK refurb/electronics or home goods with weighty parcels, test DHL inside Simple Delivery and compare claims+damage rates vs legacy flows.

- Update your warehouse cartonization rules to better map to eBay’s pre‑set parcel sizes for cost predictability. eBay UK

6) Russia’s Ozon posts a profitable quarter—another sign of marketplace operating leverage

Ozon Q2 2025: revenue up ~87% YoY to RUB 227.6B; GMV ~RUB 958.4B (+51%); net profit positive after losses last year; Adj. EBITDA up with a ~4% margin. Management credits logistics cost optimization and fintech growth. Reuters

Why this matters for operators outside Russia:

- Even in volatile macro contexts, marketplaces that own logistics and payments flywheels can squeeze out profitability—implying continued pressure on seller fees and service monetization elsewhere. Budget now for platform take‑rate creep (shipping fees, payment fees, ad load).

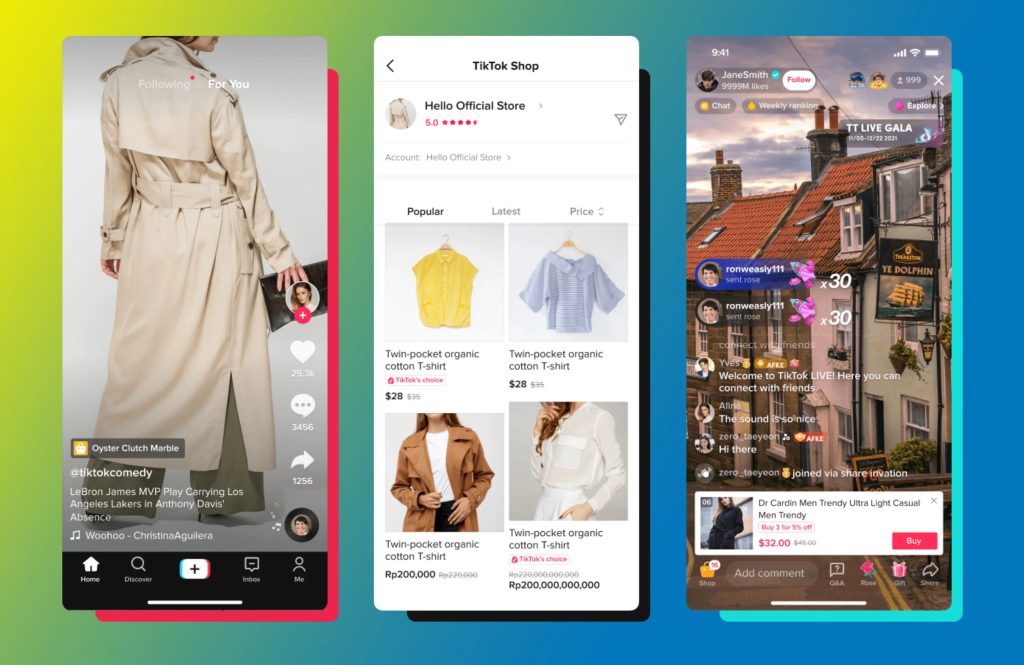

7) SEA platform dynamics: fees/taxes tightening while TikTok Shop scales

- Indonesia: Tokopedia and TikTok Shop are rolling out a Rp 1,250 (≈ $0.08) per‑order processing fee (August 2025). Shopee Indonesia also implemented the same fee in July. Expect sellers to feel margin pressure and pass some costs on to buyers. Tech in Asia+1

- Vietnam: From July 1, 2025, marketplaces (Shopee, Lazada, Tiki, TikTok Shop) withhold VAT and PIT on behalf of individual sellers under Decree 117/2025/ND‑CP—a material compliance shift for the long tail. en.qdnd.vn

- Thailand: Authorities are tightening tax compliance for influencers and online sellers; sector size and rapid growth are in focus, and a formal 3% withholding reference appears in platform documentation (TikTok Shop TH). 越南快讯国际抖音商家工具

Why this matters:

- If you sell into SEA while sourcing in China, assume higher platform take rates and tighter tax compliance—this favors consolidation to preserve margin (fewer entries, better broker rates, improved duty/VAT handling).

Tactical takeaways:

- Re‑price SEA lanes with a fee sensitivity model (each Rp 1,250 adds up at volume).

- For Vietnam, confirm your tax IDs are synced to marketplace accounts and that your invoice flow aligns with withheld VAT/PIT rules. DNP Viet Nam Law Firm

8) Macro backdrop: China’s exports are still growing, and peak‑season ocean fees are rising

- China July 2025 exports grew 7.2% YoY in USD terms (imports +4.1%, trade surplus ~$98B), reinforcing a gentle tailwind for outbound volumes. Akm

- Maersk is hiking Peak Season Surcharges from Far East → Australia/South Pacific (late Aug) and adjusting Far East → Mediterranean PSS (mid‑Aug). CMA CGM is adding a low‑water surcharge on Manaus, Brazil routes (from Sept 1). Translation: expect Q3‑Q4 volatility on many export lanes. 马士基+1

Why this matters:

- Airfreight offers speed but gets expensive fast; ocean LCL is cheaper but exposed to PSS/GRI waves. Consolidation is the hedge: fewer entries, better cubic utilization, and leverage to negotiate all‑in rates or waived PSS tiers at volume.

9) TikTok Shop’s momentum in the UK and beyond

Multiple sources point to TikTok Shop as the fastest‑growing UK online retailer in 2024, with some analyses saying it rose to #3 in UK e‑commerce rankings in 2025, while TikTok’s own Shopping reports highlight 131% YoY growth in UK shoppers and surging live‑commerce activity. Newsroom | TikTok+1Jing Daily

Why this matters:

- Fast channel growth + low‑AOV, impulse‑friendly categories (beauty, accessories, small electronics) = perfect for consolidated air or sea‑LCL.

- Live shopping’s variability makes inventory positioning crucial: pre‑stage fast‑movers in a EU or UK bonded warehouse to hit sub‑48‑hour delivery promises after a viral live.

Tactical takeaways:

- Maintain a dual‑track logistics plan: air‑consolidate weekly for top sellers, sea‑LCL biweekly for the long tail.

- Align HS codes/docs in advance to support single‑entry clearance on consolidated masters, then split domestically.

10) Putting it together: an operator’s playbook for EU/US importers of China‑origin goods

A) Upgrade your consolidation from “cost tactic” to core strategy

- Pre‑alert discipline: require suppliers to send ASN + packing photos (for serial‑numbered electronics) before your warehouse receives.

- Risk‑graded repacking: anti‑static wrap + foam bracing for electronics; edge crush‑rated cartons; tilt and shock indicators for high‑value pieces.

- Docs consolidation: 1 master commercial invoice, 1 master packing list, and a unified HS code index—the fastest route to clean clearance.

- Broker orchestration: negotiate bulk entry fees and guaranteed clearance windows for IOSS (EU B2C) and Section 321 (US de minimis), where applicable.

- Returns loop: emulate SHEIN/Jadlog: QR returns, pickup‑point networks, and refund-on-scan to reduce support load. ecommercebrasil.com.br

B) Carrier and lane diversification

- Post + Integrator + LCL mix: add China Post lanes for small parcels to Japan/North Asia; keep integrators for premium SLA lanes; leverage sea‑LCL + air‑LCL for economy. 新浪财经

- PSS hedging: negotiate seasonal caps or index‑linked surcharges with forwarders. Document when PSS applies and when mitigations kick in. 马士基

C) Tax & duty readiness for Europe and North America

- EU: map IOSS flows for B2C <€150; for B2B, enforce EORI and Incoterms clarity (DDP vs DAP).

- US: evaluate Section 321 programs for <US$800, but watch aggregation rules and routing via Canada/Mexico.

- LATAM pilot: if you’re testing Uruguay or neighbors, set up de minimis calculators and contingency budgets as policy changes can arrive quickly.

D) Platform‑specific optimizations

- Amazon/Shopify: tie inventory replenishment cycles to weekly consolidations; forecast around Prime‑like spikes and Shopify live drops. 亚马逊新闻Shopify

- eBay UK: for big‑and‑bulky items, shift listings to DHL within Simple Delivery, and document your claims process (photos at pack‑out + collection scan). ChannelX

- TikTok Shop UK/EU: standardize “live kit” packs (pre‑labeled inner cartons) so a viral stream translates into same‑day dispatch from your UK/EU hub. Newsroom | TikTok

11) Case example: 5 suppliers → 1 compliant, damage‑resistant export

Scenario: 5 Shenzhen electronics suppliers; 210 kg gross; mixed HS (smartphones, earbuds, power banks); ship to Germany (B2C + B2B).

The consolidation way:

- Supplier ASNs include serials; warehouse conducts photo verification on receipt. Anti‑static wrap + foam; reinforced outer cartons; shock indicators.

- Docs: unify into one master invoice, master packing list, and HS index (phones 8517.12, earbuds 8518.30, power banks 8507.60, etc.).

- Entry strategy: if B2C <€150, channel through IOSS; if B2B, normal customs with one MRN to minimize broker fees.

- Mode: air‑LCL weekly pallet to Frankfurt for high‑O2O SKUs; sea‑LCL biweekly for the long tail; last mile via DHL/DPD.

- Returns: adopt QR drop‑off via lockers; refund on scan + photo, restock in bonded zone.

Expected lift:

- Cost: 50–70% lower vs shipping each supplier separately (fewer airway bills, single clearance, better volumetric use).

- Reliability: damage claims down 50–70% from sturdier packing and fewer touches.

- Cashflow: refunds on scan reduce support tickets and speed reorder cycles.

12) Risks to monitor (and how to derisk)

- Surcharges/GRIs: Lock in peak windows and use index caps; split cargo across 2–3 carriers. 马士基

- Policy shifts: Uruguay’s surge shows rules can tighten; maintain legal watchlists for your top countries.

- Platform fees/taxes: Indonesia/Vietnam tightening means margin simulations should include order‑level fees and withholding. Tech in Asiaen.qdnd.vn

- Customs audits: Your unified HS index must match product realities; keep serial‑photo trails (especially for CE‑marked electronics).

13) Bottom line

Global e‑commerce is in a “quality growth” phase: platforms are monetizing logistics harder, tax authorities are standardizing compliance, and carriers are juggling capacity with peak‑season premiums. But demand is there—and growing—across Amazon, Shopify (especially in Europe), and social commerce like TikTok Shop. The winners on the merchant/shipper side will be those who treat consolidation as infrastructure, not an afterthought: unified documents, predictable pack‑outs, and clever routing that blends air parcel, air‑LCL, and sea‑LCL—plus returns workflows that mirror the QR + pickup convenience consumers already love in Brazil.

Do this well, and you’ll ship cheaper, cleaner, and faster—without giving up reliability.

Sources & further reading

- SHEIN + Jadlog reverse logistics (QR returns, ~20% cheaper; 4,000+ pickup points). ecommercebrasil.com.bresginside.com.br

- China Post Jinan–Tokyo route (CF279; 3 flights/week; B737‑800F), plus earlier Hangzhou–Tokyo launch. 新浪财经+1腾讯新闻

- Uruguay cross‑border surge after Temu’s entry (local press & industry bodies).

- Amazon Q2 2025 earnings (International +16% YoY). 亚马逊亚马逊新闻

- Shopify Q2 2025: +31% revenue; Europe GMV +42% (cc). s27.q4cdn.comShopify

- eBay UK adds DHL to Simple Delivery (up to 30kg, 120×80×80 cm). ChannelXcommunity.ebay.co.uk

- Ozon Q2 2025 financials (revenue +87% YoY; GMV +51%). Reuters

- Indonesia per‑order fee Rp 1,250 (Tokopedia, TikTok Shop; Shopee). Tech in Asia+1

- Vietnam tax withholding by e‑marketplaces (from July 1, 2025). en.qdnd.vn

- China July 2025 exports +7.2% YoY. Akm

- Maersk PSS increases; CMA CGM low‑water surcharge (Manaus). 马士基+1

- TikTok Shop UK growth/positioning. Jing DailyNewsroom | TikTok+1